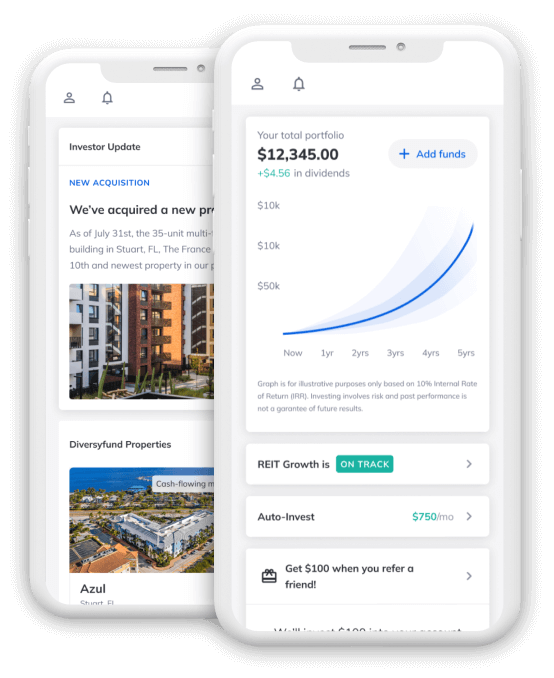

With on-demand access to your portfolio

The DiversyFund app lets you monitor and track the performance of your investments.

Get StartedThe fund or asset is open to investors and initial capital is being raised and deployed to purchase multifamily properties or fund the asset.

Multifamily assets are purchased following a rigorous vetting process that identifies properties we believe offer excellent growth opportunities.

Professional management is overseeing construction, maintenance, or upgrades as part of the value-add strategy.

Renovations are completed, and the asset has entered the natural appreciation stage.

The fund/asset is nearing the end of the cycle, and the time is right to seek potential buyers.

The single asset or portfolio of properties is sold, and the net proceeds are distributed to investors.

*REITs are required by IRS rules to distribute 90% of net profits to investors in the fund

Did you know?

At any one point in time, assets in the portfolio can be in more than one phase due to market conditions.

Example: A property is being renovated while it is collecting rents.

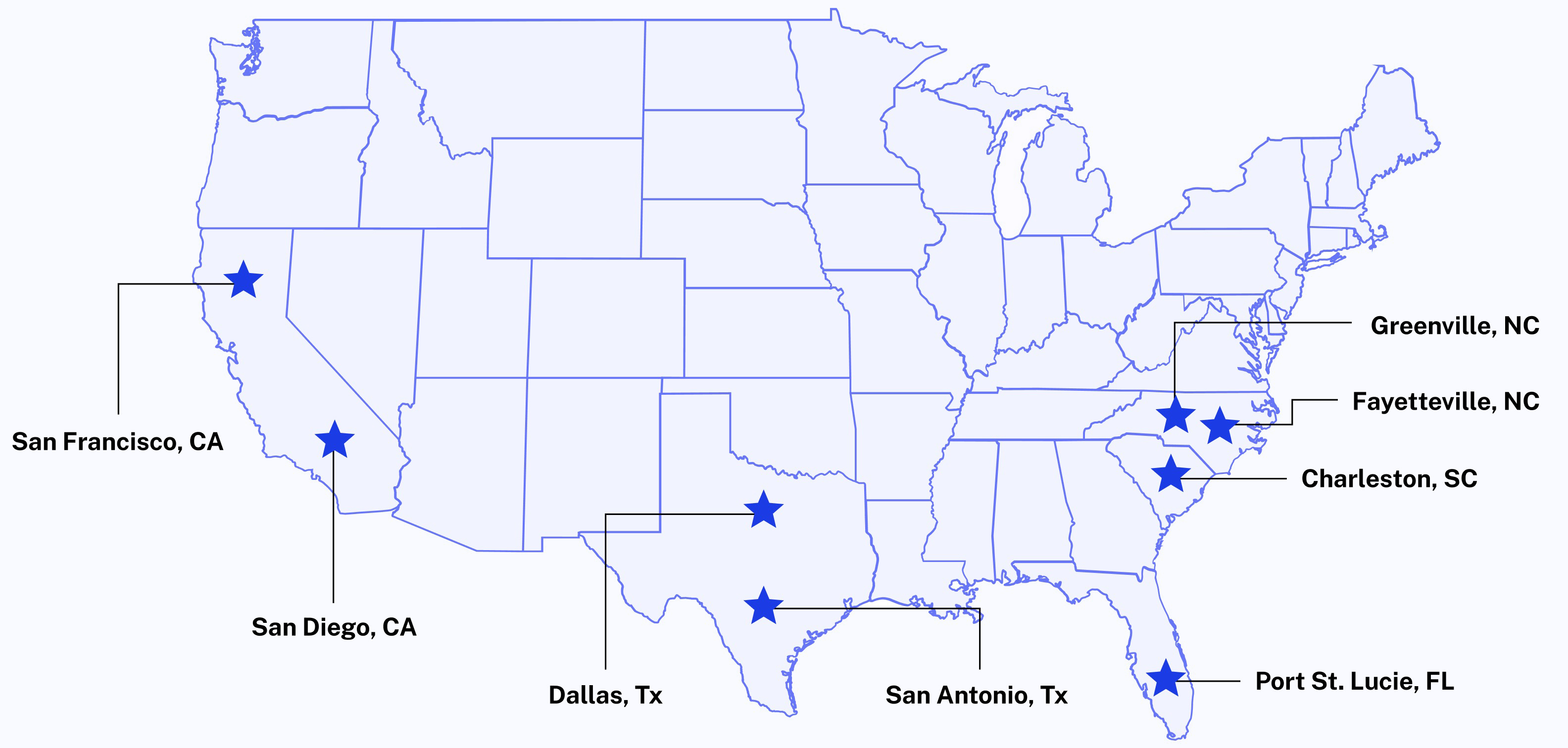

We’ve Invested in Multifamily Properties Across the US

With on-demand access to your portfolio

The DiversyFund app lets you monitor and track the performance of your investments.

Get Started