An Essential Alternative To Diversify Your Investment Portfolio

Portfolios with an allocation to private real estate offer strategic opportunities for growth while providing a strong hedge against market volatility and inflation. Unlike playing the stock market, investing in real estate lets you better mitigate risk without sacrificing potential returns. And best of all, DiversyFund’s Growth and Single Asset offerings provide a simple, hands-off approach to investing, so you don’t have to become a landlord just to make your money work better for you.

Benefits of Real Estate

Hedging Against Inflation

Investing in multifamily real estate assets can provide a powerful hedge against inflation. Rising costs in home ownership typically lead to more people renting, and increases in rent for multifamily assets can provide increased cash flow without adding to overall costs. Historically, the real estate market has also tended to be a significantly better investment option than the stock market during periods of higher inflation. As inflation rises, real estate values also typically rise, making the asset class a worthy addition to your portfolio.

Balancing Market Volatility

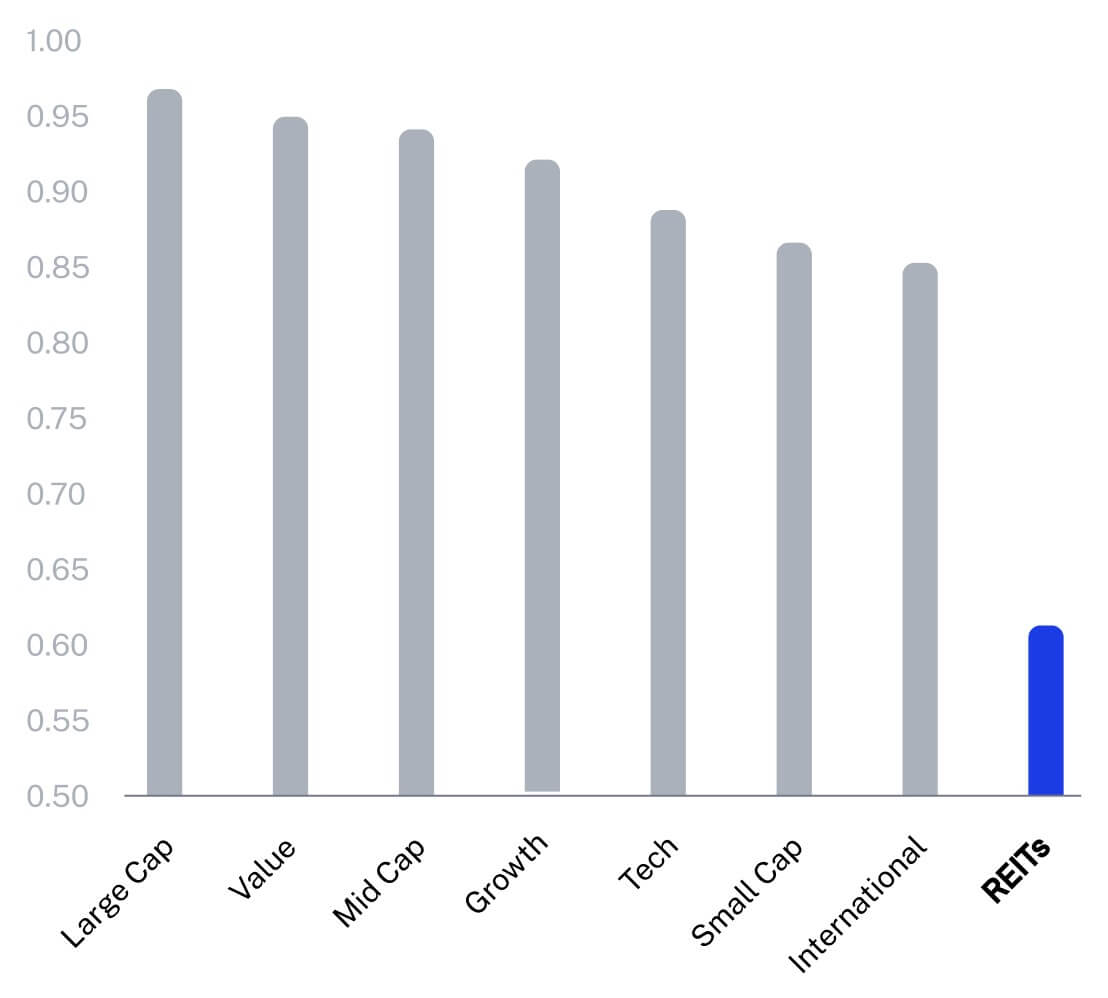

Publicly traded stocks and bonds are subject to dramatic short-term swings, from extreme highs to extreme lows, in response to everything from international news to political events. These swings make investing in stock markets highly volatile . Because the real estate market moves at a considerably slower pace than the public markets, it’s less likely to experience dramatic changes over time. By adding real estate to your portfolio, you can help mitigate some of the risk you’ve assumed with stock, bond, and mutual fund investments.

Long-Term Investment Solution

Whether you’re planning for retirement or you want to build on the wealth you already have, real estate offers a smart long-term investment solution. Historically, the multifamily real estate market has been shown to outperform other asset classes. This makes it an excellent option for long-term investing. Unlike stocks that are bought and sold in a single day and other short-term investments, real estate investing offers a commitment to building wealth over time.

Tax Benefits

Investing in the real estate market provides opportunities to realize tax benefits on your investments, including pass-through deductions. By reducing your taxable income, your real estate investments can help your money go further. As with any financial decision, it’s important to consult with a tax professional.

DiversyFund’s Real Estate Offerings

Our two offerings- Growth and Premier- provide you with options, based on your preferred risk level and overall experience with investing. You can select from Growth and Premier offerings, each with its own unique benefits, to find the best fit for diversifying your portfolio and mitigating risk while still targeting attractive returns.

Premier Offerings

Invest in exclusive single-asset offerings for accredited investors

Single-asset offerings at DiversyFund let more experienced investors take charge of their real estate portfolios by selecting investment assets based on their location, size, and other distinguishing features. Your money goes to work in a private multifamily real estate asset you’ve personally selected, so you remain in control of your long-term growth plan.

Browse Premier Offerings

Growth Offerings

A portfolio of multifamily assets for diversification

DiversyFund’s REITs let individual investors receive the benefits of investing in the real estate market without taking on the risk and hassles of ownership alone. A curated portfolio of assets works to balance risk, while the easy-to-use app and dashboard let you track your investments in DiversyFund real estate assets and take control of your financial future.

Browse Growth OfferingsOur Real Estate Investment Strategy

Diversyfund value-add offerings and single asset investment opportunities are illiquid during the 5-to-7-year investment horizon, providing a reliable opportunity to diversify and solidify your portfolio. All multifamily real estate assets are researched thoroughly before acquisition, and each step of the growth plan is vertically managed by the Diversyfund Team.

Get Started

Historical Returns (RE)

Historically, real estate has a proven track record and has outperformed the stock market 56% of the time, especially in periods of inflation. REITs – like DiversyFund’s Growth REITs – have an average annualized return of 11.2%*, making them a viable option for bolstering your portfolio.